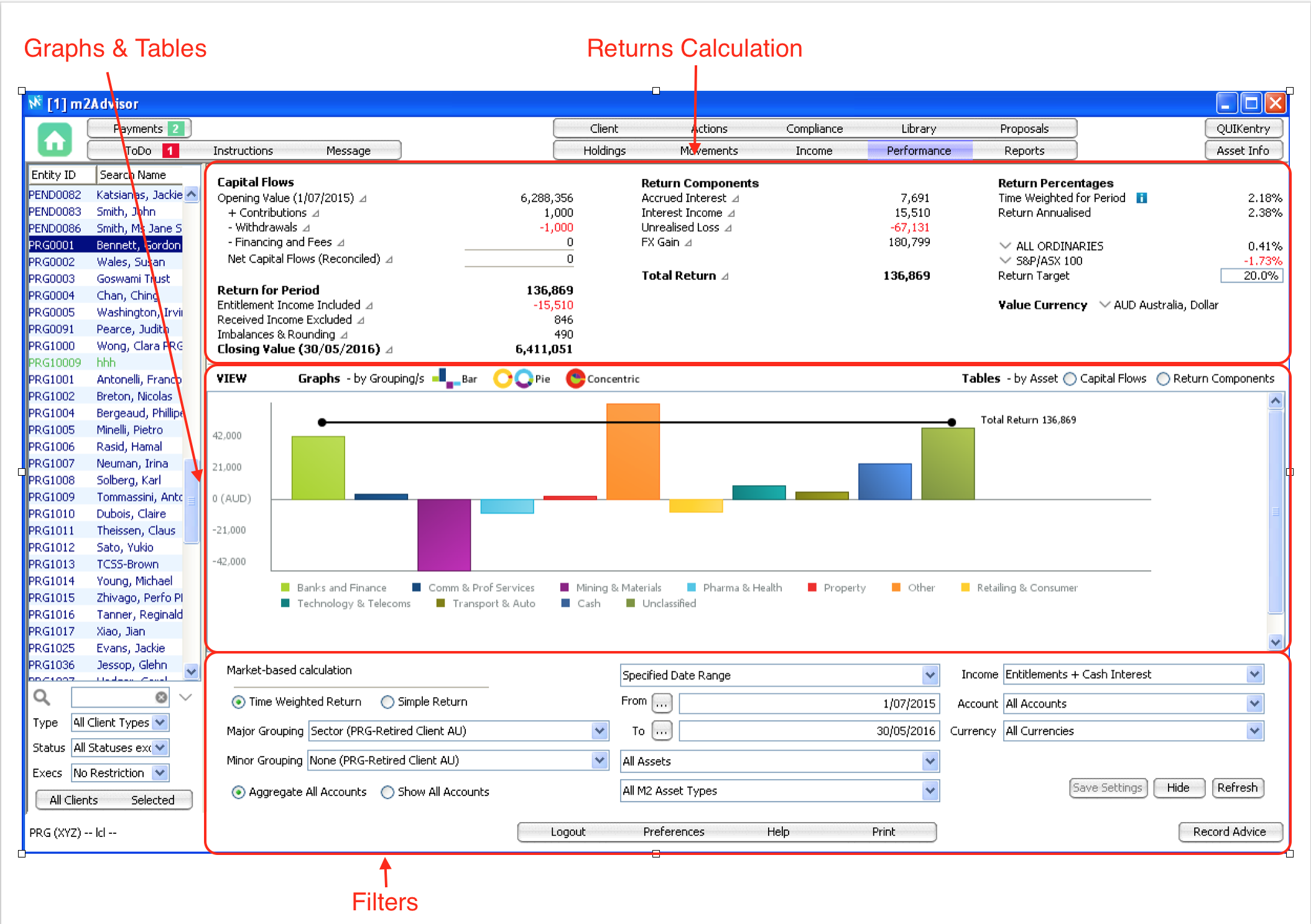

Performance View

Capital Flows:

Hovering over each item in this section will open an information box with full explanation and calculation method of that item.

Opening Value:

The Portfolio Market Value excluding 'Accrued Interest' as at the start of day of the Start Date.

Total asset holdings as of market price on that date.

Contributions:

Those movements occurring between the Start and End dates which have been classified as 'Contributions'. These should typically be limited to Cash Deposits of new investments funds or the Transfer In of Assets free of cash payments in M2.

NB: Some Custodians/Clearers do not differentiate between new Cash Deposits and Settlement Transfers flowing between trading and cash management accounts, which can significantly distort the true 'Contribution' amount, and thereby distort the TWR Return calculations. Where incorrect classification s have been applied, it is important to change the classification of any such movements from 'Contribution' to 'No Capital Flow'.

Withdrawals:

Those movements occurring between the Start and End dates which have been classified as 'Withdrawals'. These should typically be limited to Cash Withdrawals or the Transfer Out of Assets free of payment from the M2 portfolio.

NB: Some Custodians/Clearers do not differentiate between true Cash Withdrawals and Settlement Transfers flowing between trading and cash management accounts, which can significantly distort the true 'Withdrawal' amount, and thereby distort the TWR Return calculations. Where incorrect classification should been applied, it is important to change the classification of any such movements from 'Withdrawal' to 'No Capital Flow'.

Financing and Fees:

Management Fees charged to the Client, Bank Fees charged or custody and Administration, Interest Charged on Investment or Cash Management accounts (excludes Accrued Interest adjustments on Buy/Sell transactions).

Net Capital Flows (Reconciled):

The sum of the Contributions, Withdrawals, Financing and Fees which represent the Net Capital Flow contributed or withdrawn from the Portfolio by the Client and therefore not contributing to the 'Return'.

Return Components

Hovering over each item in this section will open an information box with full explanation and calculation method of that item.

Realised Profit and Loss:

This is the total of all Gains and Loss Realised during the Performance Period attributable to the Performance Period. This is the difference between the amount of a 'closing transaction' (such as a Sell of a long position or a Buy of a short position etc) and the 'Average Accumulated Cost' for that holding. Where the Realised Gain/Loss has been generated from a holding which existed in a period prior to the Start Date of the Performance Period, a proportion of the Gain/Loss is deducted for the Prior Period as that portion of the Gain/Loss will have already been 'taken' in the Prior Period as 'Unrealised' Gain/Loss.

Unrealised Profit and Loss:

This is the total of the Unrealised Gains/Losses for each position still held at the end of the Performance Period which is attributable to the Performance Period.

It is calculated by deducting the difference between the Cost and Market Value as at the Start Date, from the difference between the Cost and Market Value as at the End Date.

Where a portion of any prior-period Unrealised Gains/Loss has been used to adjust the Realised Gains/Loss for the Performance Period, then this will be added back into the Unrealised Gains/Loss for the Performance Period.

Total Return:

The total of all the Return Components.

Return for Period

Entitlement Income Included = Entitlement income calculated which may have been paid to the client (typically at a date later than entitlement date); may also include the value of accrued interest adjustments on buy/sell cash postings which may have been receipted outside of M2

Received Income Excluded = The total of Dividend and Bond Interest income (except cash interest on bank accounts) receipted into M2 which has been excluded from the Return in favour of using ‘Entitlement Income’ instead. This needs to be shown to achieve reconciliation with the Closing Value.

Closing Value = Portfolio Value as at the end of day of the end date plus the Accrued Interest calculated under Return components.

Return Percentages

Modified Dietz Method

Performance = Total Return for the Period /(Opening Market Value + Day-Wighted Cashflow)

Sum of the Net Capial Flows (Contributions, Withdrawals, Financing and Fees) after being adjusted for the date on which they occurred.

(i.e. Transaction Value* ((Days in Period - Date of Transaction)/Days in Period))

Benchmarks

Advisors can choose a benchmark rate to compare the client's portfolio returns and set a target return figure. The benchmark rate will be included in the reports generated.

Other Views

Graphs & Tables

Graphs - by Grouping/s: select bar chart, pie chart or concentric

Tables – by Asset: select Capital Flows (detailed view of deposits and contributions) or Return Components (detailed view of returns components by asset)

Filters

Set Major and Minor Groupings (Country of domicile, manager, asset class, asset types), date range, all assets or a specified asset, all asset types or a specified asset type, all custodians or a specified custodian, and currency.

There are 2 types of return calculation:

- Time Weighted Return

- Simple Return

Time Weighted Return = Total Return for the Period /(Opening Market Value + Day-Weighted Cashflow)

Simple Return

When you click ‘Print’ the Performance Report Contents window opens. This shows all the report components and allows you to click on any item to de-select it to exclude it from the report. You can then save this Print format as Advisor Default or Client Default, for future performance reports, if you like.

Comments

0 comments

Please sign in to leave a comment.